Action hubs

Lebanon

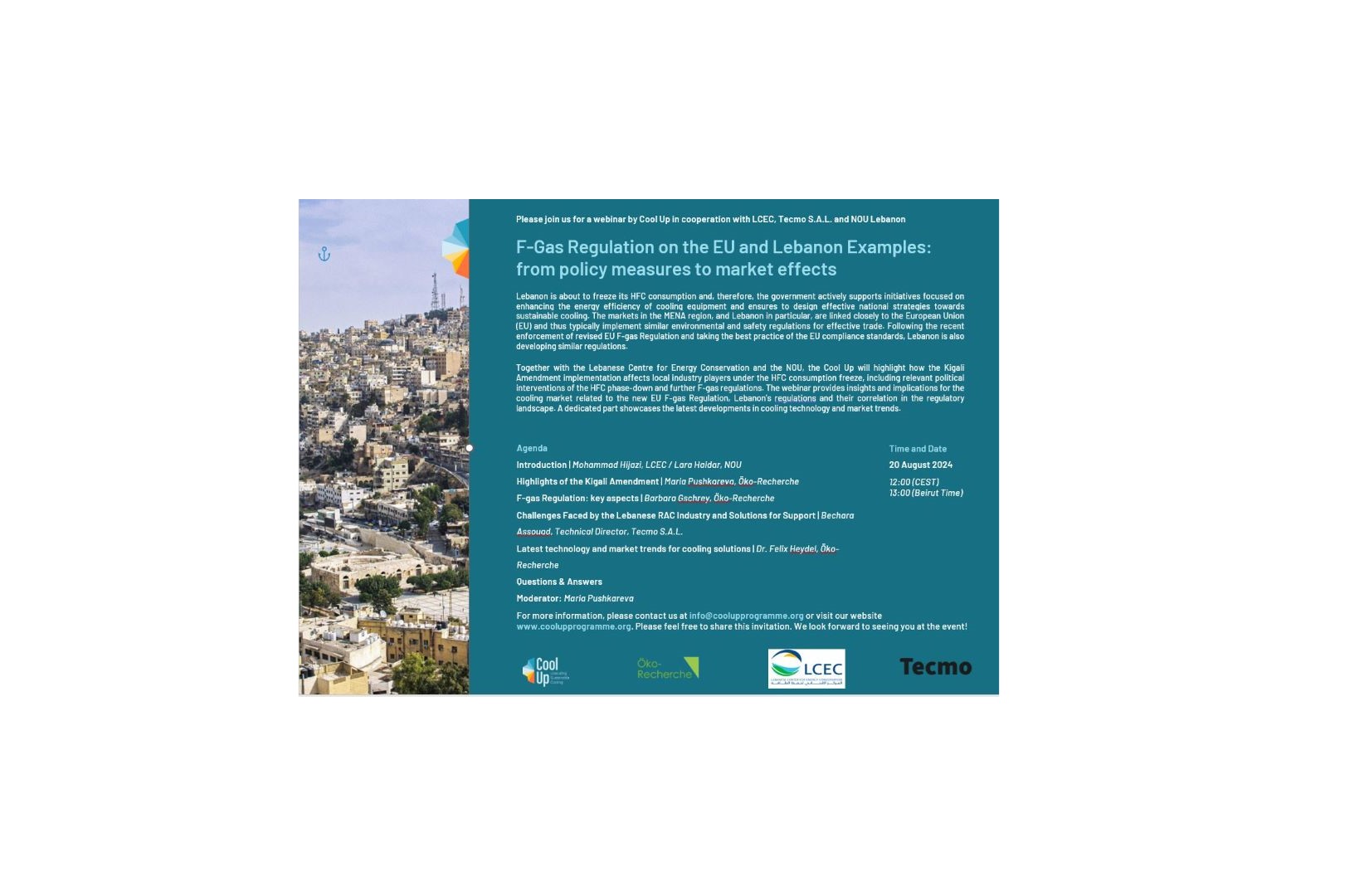

Lebanon is a signatory of the Montreal Protocol and has ratified the Kigali Amendment. Lebanon has also developed a National Cooling Plan, which outlines a roadmap for the transition to carbon neutrality in the cooling sector by 2050, amongst other actions. Cool Up supports Lebanon in implementing the Kigali Amendment by developing relevant policies, developing technology and financial research and products, and deploying capacity building programmes.

Understanding Lebanon

The country has a Mediterranean climate with hot, dry summers that require cooling. Cooling degree days in Lebanon are two times higher than heating degree days and can exceed 1300 a year. In 2018, cooling energy consumption made up approximately 32% of total Lebanese electricity consumption, with the residential sector constituting 50% of total cooling consumption. Despite its recent economic challenges, Lebanon is expected to see a 75% increase in final energy consumption in buildings by 2030. Cooling and dehumidification are the highest energy-consuming end uses in the Lebanese building sector.

expected increase in final energy consumption in buildings by 2030

of the total electricity demand in 2018 from the refrigeration and air conditioning sector

emissions from refrigeration and air conditioning sector in 2020

Lebanon’s Montreal Protocol & Kigali Amendment commitments

Lebanon is committed to the Montreal Protocol and ratified the Kigali Amendment on 5 February 2020. In line with Montreal Protocol obligations, Lebanon is implementing a staged approach to comply with the adjusted control schedule. Activities relating to industry phase-out contributed to a decrease in HCFC consumption in the country. Currently Lebanon is focusing on phasing down HCFCs in the refrigeration and air conditioning industries and the servicing sector, as well as implementing technical workshops to technicians in the field.

"Lebanon is not backing down on its Paris commitments and is eager to build back better and implement the Kigali Amendment".

"We are very committed in Lebanon to both the Montreal Protocol and the Paris Agreement, with the main objective under these two agreements to phase-down HFCs in accordance with the Kigali Amendment".

Lebanon’s Nationally Determined Contributions (NDCs) emphasise the recently published National Cooling Plan and states that fluorinated gases will be added to the NDC’s gas coverage once they have been included in Lebanon’s greenhouse gas inventory. Lebanon has an established National Cooling Plan, which highlights proposals for developing Minimum Energy Performance Standards (MEPS) and labelling regulations, a market study to better understand the country’s stock of appliances, a financing approach to support more energy efficient appliances, and a roadmap for the transition to carbon neutrality in the cooling sector by 2050. National efforts reinforce the National Cooling Plan and Lebanon’s NDC, including the second National Energy Efficiency Action Plan (2016-2020), which tackles the development of minimum energy performance standards and labelling for several equipment types, including cooling and heating systems.

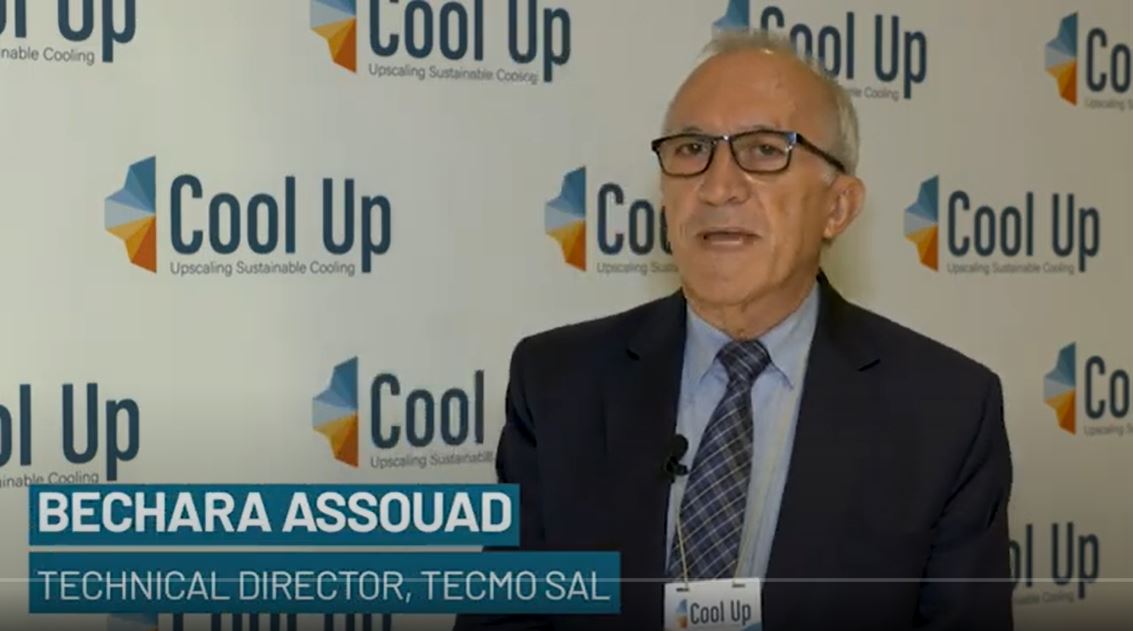

The Lebanese air conditioning, commercial refrigeration, and refrigerants markets are import dominated. The national market consists primarily of companies that assemble the equipment parts and serve the domestic market. Although the market is dominated by high global warming potential refrigerants, some natural refrigerant solutions are currently used in central chillers.

Currently three financing programmes or facilities exist to fund green initiatives in Lebanon. These focus on private investment in renewables, energy efficiency initiatives, green buildings, and green technologies. Financial institutions are familiar with energy efficiency lending concepts, which could be translated to sustainable cooling solutions with support from Cool Up.